Comarch Telecommunications, the company’s specialist division that designs, implements and integrates IT products for telecoms, together with Mobile World Live, has conducted an online survey on the state of AI implementation in the industry for the year 2020.

As telecom operators all over the world are looking for ways to make their networks more dynamic and respond better to market demands, artificial intelligence becomes a technology of interest for the industry. The “Artificial Intelligence, Machine Learning and the Future of Telecoms” survey report proves that AI-driven technologies are playing a key role today and will continue to do so in the decade ahead. The research also gives insight into the benefits of this technology and the areas it will best support.

“Everything indicates that 2021 will finally be the year that AI blooms in the telecom industry. Operators are increasingly aware of the power behind this comprehensive technology, and many of them have already introduced it in some way, or are planning to do so in the upcoming months. It is also clear that, if we want to take full advantage of the potential of 5G services and enter the Industry 4.0 era, we must take AI and ML seriously, as these are what will make the emergence of new services possible. We conducted this research in order to find out the real state of AI implementation among different telecoms around the world – where and how are they applying the technology, the benefits they notice, and what problems are they facing.” ,says Dominik Pacewicz, Head of Product Management in Comarch.

The survey report is divided into four parts, focused on different AI implementation areas.

Part one: Operators’ AI and Machine Learning Strategy

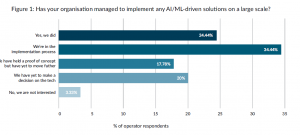

The first part focuses on telecoms strategy when it comes to AI applications. The survey found that 58.8% of respondents have either already deployed the technology or are in the process of doing so. Only 3.33% declare no interest in implementing AI.

Part two: The Effects of AI/ML on a Network

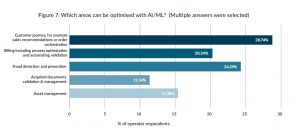

Among many advantages of AI/ML utilization in telecoms, flexibility and versatility are the most important. Operators believe that artificial intelligence can help them with optimizing many different operations and services, which include OSS, BSS, FSM, assurance, and more.

Part three: Operators’ AI Technology Preferences

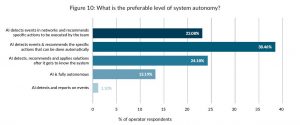

The third part of the survey is all about telecoms’ “personal” preferences, when it comes to applying AI technology. Here, the goal was to find out what operators truly want from AI. And, quite surprisingly, a great many respondents are open to fully or semi-autonomous technology.

Part four: Problems with Implementing Artificial Intelligence

With all the benefits, the greatest potential of AI-driven technologies is still ahead of us. This part of the research objective was to learn what stops operators from applying more AI solutions to their operations. Are legal issues the reason? Or maybe telecoms are still lacking the knowledge and skills required to implement the technology on a larger scale?

“Among the survey’s respondents, they were more honest about the lack of relevant skills being the biggest obstacle to implementing AI – it was cited by 40.7% of operators, compared to 35.0% of all respondents. The second biggest obstacle to operators was the high costs of AI or ML implementation (20.9%) – an understandable response given the capex and opex challenges the telecoms sector faces. This was closely followed by a lack of staff resources to devote to training machine learning algorithms (19.8%).” – Survey Report: Artificial intelligence, machine learning and the future of telecoms, 2019

If you’d like to read the full study and learn how operators around the globe implement AI, the extent of their spending, and the fears they need to face, download the full report here.

The report is based on responses from an online survey of 226 respondents, conducted by Mobile World Live on behalf of Comarch. Mobile network operators with annual revenues of more than $10 billion accounted for 15.5% of respondents and 4.0% were from MNOs with annual sales of between $5 billion and $10 billion. A further 20.8% of respondents were telecoms operators with revenues of less than $5 billion. The remainder comprised telecoms vendors, fellow AI and ML specialists, industry analysts and other interested parties in the field. Geographically among operators, Europe was most represented (48.4%), followed by Asia (28.6%), North America (11.0%), Africa and the Middle East (both 4.4%), South America (2.2%) and Australia (1.1%).

About Comarch

Comarch is a global supplier of software and services for enterprises. It has more than 27 years of experience designing, implementing, and integrating IT solutions for some of the world’s largest brands including BP, Deutsche Telekom, Diageo, KPN, Orange, Telefónica, LG U+, Unilever, and Vodafone.

Comarch has a specialist telecoms unit providing IT solutions to telecoms operators around the world. It builds technology solutions to meet the key requirements of telecoms companies, namely to increase revenue, grow business efficiency, simplify systems, cut costs, enhance the customer experience, build new services and shorten their time to market.

Comarch has also been recognized for its work in the telecoms industry by other analysts, including Gartner, Forrester, Informa, and Frost & Sullivan.

Source: Comarch